We all know our common friend, the inflation. Inflation basically means the increase in the general price level of goods and services. In practice this means that when time goes by, you are able to buy less with your monthly salary than before. For example if inflation-rate is 2 %, that means that the general price level is rising all the time with a rate of 2 % and the real value of your money is decreasing with a rate of 2 %.

The European Central Bank for example has a goal of maintaining the rate of inflation at below but close at 2 % in the medium term. However, in some countries like in Venezuela, the inflation-rate is currently estimated to be 11 200 000 %. That means that the Zimbabwean dollar is almost completely unvaluable! Even Habbo-coins are 60 000 times more valuable currency than the Zimbabwean dollar.

My friend actually showed me a bill of 1 000 000 000 000 Zimbabwean dollars that he has managed to get from his cousin in Africa. He also said that the monthly salaries of people are delivered by a truck! In the restrooms it is forbidden to use bills as a toilet paper. How on earth did Zimbabwe get into this situation

Couple of reasons exist for hyperinflation. First of all is corruption. In the countries where the government have their hands on the central bank, it might become lucrative to fund the government's deficit by printing more money. This increases rapidly the money supply in the economy, which according to quantity theory of money, increases inflation. For example in Zimbabwe, the Mugabe administration decided to print more money in the early 2000's to increase the salaries for the people in the government and in the military. These economic mis-steps inevitably lead to unrest and poverty. Because of corruption and excessive money creation, the economy and and the people are suffering.

Now the big question is that is the hyperinflation a fixable problem? Well, at least in Germany after the first World War, the government managed to get the hyperinflation in control. This was done basically by inventing a whole new currency to be backed by mortgage bonds indexed to the market price of gold at the time.

If Zimbabwe and Venezuela want to do the same, this suggests that they would have to also abandon the old currency and to develop a new one. Unfortunately in the current foreign exchange market most of the values of the currencies are determined by the supply and demand of these currencies. It is very rare to possess a currency that would have its value fixed or pegged to some commodity, for instance. This might make it difficult for example to Zimbabwe to find the demand for its new currency.

I started to think an interesting option: Bitcoin. Most of the currencies are inflationary, but would virtual currencies such as Bitcoin work as an official currency of a country? What if the official currency of Zimbabwe would be Bitcoin?

Bitcoin is considered a very controversial currency. For instance, the European Central Bank has stated that it doesn't define Bitcoin as a currency, since it doesn't possess enough characteristics and qualities of a currency. I would agree on that. Bitcoin seems more of a speculative instrument for investors than an official currency. Although Bitcoin is already used in the internet as a valid currency for payments between consumers and service providers all over the world.

If something is interesting in Bitcoin as a currency, it is the fact that unlike any other currency we know, Bitcoin is a deflationary currency. This means that the real of Bitcoin is increasing over time (or at least has increased). Euro, pound sterling and the dollar on the other hand have decreased in real value over time as you can see from the graphs above. Why you ask? The inflation.

But why doesn't Bitcoin produce inflation? The maximum amount of Bitcoins in the world is fixed. The algorithm in the so called block-chain creates more and more Bitcoins with a decreasing growth rate, until the maximum amount is reached. In practice the calculations become more and more complex and when more Bitcoins are created, the more time it takes to create more. Because the supply of money in this case is fixed, Bitcoin doesn't create inflation in a way like traditional currencies do.

This is why the value of the currency is increasing. When the demand for Bitcoins increases, the value of the Bitcoin also increases since the supply cannot adjust to the increased demand for Bitcoins.

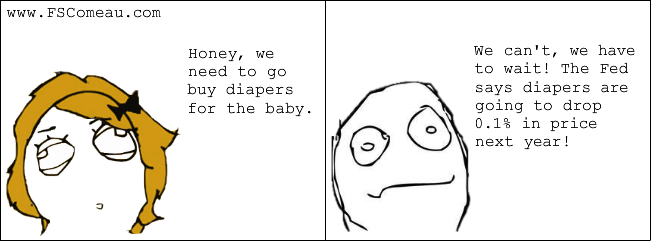

The consequences of using a deflationary currency could be interesting. There exist a danger that consumers are waiting for the value of their currency to increase before consuming goods and services. This would decrease the amount of consumption in the economy and can lead to lower rates of economic growth. Also the amount of investments will be reduced when the currency itself can be seen as a form of investment. Similarly the reduced revenue of firms and corporations can lead to unemployment.

But what about a country like Zimbabwe, where already the unemployment rate is over 90 % and the level of investments and consumption are relatively low? In theory the negative effects are already been gone through, so we would need to focus on the positive effects of deflation.

Deflation itself increases the amount of disposable funds especially for middle class and poor people, when the value of their small amount of money is increasing. This might be used to boost the consumption in the Zimbabwean economy. Similarly deflation would require the central bank to lower its interest rates, which would make loans more cheap for consumers, which could can increase the amount of consumption in the economy even more.

Deflation would also decrease the value of assets when the currency would become an alluring form of investment. Then the wealth of the rich government officials who own for example property and stocks, would decrease. When the wealth of the poor people on the other hand increases, this would also decrease the economic inequality in the economy.

When more loans are granted, this would also mean that the money supply in the economy would increase again. However the maximum amount of Bitcoins is fixed and this relationship would create an interesting dilemma I would need to think further. I also know there are probably many controversies concerning these theories but I wanted to discuss some of my thoughts on the matter.

Text SW

Pictures don't belong to me

.jpg)

No comments:

Post a Comment