Saturday, 28 October 2017

Could AI make us all rich?

During the past week I found an interesting article about an ETF that is managed by AI. The ETF is all about IBM's Watson-platform managing the portfolio by analyzing one million market signals and news articles from 6000 companies on a daily basis. It uses a portfolio of 60-70 companies that Watson selects by optimizing lower risk and capital appreciation.

The concept is so fascinating that I couldn't help myself thinking it further and write about this. Could this kind of AI make human portfolio managers unemployed some day? Could this kind of ETF be more profitable in the long-run because it has no human error in portfolio optimization?

For these questions I had to consult my AI-expert (who we can call with an alias Kolari for example) so that I could have e better perception about an AI as a portfolio manager.

It is true that the AI is free of human emotion. It doesn't experience greed or fear, the two most common feelings in the stock-market. The AI doesn't make human errors in picking companies and it doesn't sell the equities in panic in case of a market crash. Similarly, it doesn't buy stocks that are hyped by third party analysts if it sees that the stocks are overvalued or present a risk that isn't valued to the price of the stock. The stock-prices are calculated by robots and transactions are made by robots (expect in NYSE), so why wouldn't stock picking made by a robot?

As stated in the article, in theory the AI should become more efficient and more "smart" as time goes by. The AI is placed to the context of financial markets, where by analyzing data continuously, it learns more and more about the movements of the financial markets. It will become more capable of making right decisions when it has figured out what inputs create wrong decisions that produce loss and what inputs create decisions that generate profit. It is also more efficient to analyze news, reports and social media and AI requires less time to process them than a human portfolio manager.

This has been witnessed before. In the video-game world several AI's have been created to observe and learn from the best players of certain strategy-based video-games. When the AI has observed millions and millions of games and transactions from the world's best players, it can copy those strategies in order to beat other players and to learn even more from the context in which it operates. It can also copy itself hundreds of millions of times to be able to play against itself in millions of different servers. Handy, am I right?

This is where the first question arise. In what transactions will the AI actually learn while managing a portfolio? In theory it can copy the other "human players", the investors in the market but they certainly make mistakes some time. Copying them would make the AI repeat the same mistakes. However, the AI is still able to learn from them.

What Kolari suggested is that this AI should be thought perhaps as a more sophisticated analytics. In terms of that the analytics should work just fine in certain circumstances. However, even with modern technology it is almost impossible to know in which way the stocks are going. Furthermore, this kind of technology would base also partly on historical information such as decisions made in the past and on what circumstances the stocks have gone up. This means that every single thing that affects them should be inputs in this system. But we all know that historical information cannot be used as a certain way of predicting where the stocks are heading.

Perhaps the biggest reason why I'm being careful on the hype for AI-investing, is the existence of unexpected shocks. A great amount of uncertainties exist in the stock market. Have you ever wondered why the stocks start sky-rocketing if a purchase offer or a fusion notice are announced? It is because no-one could expect that these events could happen. Usually the biggest volatility in the stock-market occur because of either positive or negative surprises. I highly doubt that even an AI could expect unexpected circumstances no matter how much information is gathered. The point is that the right information couldn't exist at all before the unexpected surprise.

Still, the AI portfolio management could work and it could be the next revolution in the financial markets. It would make the AI strategy transparent for all investors, not just hedge funds that might have use this kind of technology before. However, the development of this AI could take years or even decades before it would become efficient enough and making the minimum amount of errors in portfolio optimization. We don't have much data since this AI started trading on October the 18th, only a week ago. I'm following the ETF regularly and if I'm crazy, I might put a couple of euros to it and see where it is taking me.

But I'm not yet fully convinced. A guess is more proficient when it is backed with mathematics, but in the end of the day, it is still just a guess.

Text: SW

Pictures don't belong to me

Friday, 13 October 2017

Buying the Pot

First of all I would like to present my congratulations to Richard Thaler for winning the Nobel Prize in Economics this year. The award went basically to pioneer work in the field of behavioral economics.

Now, first when people think about economics it's purely about maths. Maths maths maths maths. Integrals, differentiation calculus, matrix algebra and optimization. But every single time I'm sitting in my lectures of Mathematical Economics a quote from the Great Milton Friedman comes into my mind:

Economics has become increasingly an arcane branch of mathematics rather than dealing with real economical problems.It is true that mathematics forms the basis of economics. Some basic methods in mathematics are needed to solve economical problems such as optimal consumption bundles and utility maximization. But if we take a look at one definition of economics, it states that economics is about studying scarcity and how people use the resources their given. Economics focuses on the behaviour and interactions of economic agents and how economies work. The key-words here are behaviour and interactions.

Economics and financial markets are all about the people. The reasons of why prices vary, the levels of production are altered in the economy, why the stock-market goes up and down and why inflation exist comes from the actions you and I decide to make in different circumstances. It is all about us.

If I would be to perform research of any kinds, it would be probably to the fields of behavioral economics and behavioral finance. Let me explain why.

I don't consider myself as exceptionally good in maths, so often I and my class-mates ponder that how can I be good in economics if I'm just average in math? The answer is simple; I know my people. Through empathy it is possible to know how people feel and what do they think when making economic decisions. The're human just like me and they want to maximize their utility just like me. If you just focus on your environment and analyze people on how they behave every day, you can learn a lot about people and society and also some basics on economics.

Consider for example the awkward situation when someone you've met at some party 1,5 years ago walks on the same corridor in the University. You probably hope that he/she doesn't recognize you and you try to look away. With a high probability, the other person is thinking exactly the same and tries to avoid eye-contact. This for example might support the theory that people tend to act in the same way in the same circumstances.

The basic presumption in both micro -and microeconomics is that all the agents in the economy are rational and predictable. Producers are profit-maximizers and consumers are utility-maximizers. This might be the case in general, but when you take a look at it, you realize that not ALL the agents in the economy work rationally or act in a same way as most of the other people. However, this presumption is important in order to fit different economic models into real-life situation, even though the presumption itself is rather irrational.

Good example is the theory called money illusion. This has to do with the controversial curve called the Phillips curve. A curve invented by William Phillips describes the inverse relationship between unemployment and inflation. Milton Friedman argued that there doesn't exist a relationship between inflation and unemployment. Why? Human behavior!

If the inflation rate is 2 %, then people expect that the inflation is 2 % and decide to negotiate an increase in wages on this rate. Now if in the same time unemployment is reduced with expansionary demand-side policies, this would increase the inflation tare and the demand for labor. In the short run unemployment will decrease when higher wages attract more workers. When the workers realize that their real wages have not risen because of the higher inflation rate, some workers might quit their jobs temporarily, causing the level of unemployment to go back to the natural level. The workers have suffered from money illusion, partly caused by their rational expectations on the inflation rate.

What about the stock-market? Even though there are some fundamentals that control the stock-market it is basically about psychology. Especially different kinds of organizations giving analyzes and preferences over stocks have a considerable power when it comes to steer people towards investing in particular stocks.

If you are into investing, you might have also heard the rule that if the persons of responsibility in a firm decide to sell their own stock, that could be alert that they know something that you don't and that something sends them to short their position. This can cause a mini-panic in the stock-market where the shareholders decide to follow and sell their stocks as well.

On the other end, if the CEO Antti Herlin decides to buy worth of 30m€ stocks of Kone Corporation, that means that the Head is confident on his own business. This can push investors to buy the stock even more and through that the market-value of Kone is increasing, no matter what is really going on in the firm's operations.

The insiders know with 100 % what their actions will cause. So there exists two options: Either they really really know something, or they are trying to get an advantage from the situation.

The latter one can be described probably the Rothschild legend. It tells a tale of Nathan Meyer Rothschild who was following the Waterloo-battle and was certain that England was going to beat Napoleon's army. Rothschild rushed to London for the stock exchange and started to sell rapidly English bonds. Soon whispers started to go around that Rothschild knows that France has won the battle. This caused a panic where the investors were selling all of their bonds in fear. When the panic was about to end and the value of the bonds was extremely low, Rothschild bought a huge amount of these bonds back. Soon the news broke that England has won in Waterloo and this sent the value of the bonds sky-rocketing and Rothschild made a fortune from the trade. True or not, this represents the role of investor behavior in the financial markets.

If you know yourself and the other people, you are not the fool in the market. The fool is usually the one who doesn't know who the fool is. People say that the stock-market is a game of lottery. No, it is not. It is a game of poker. If you want to make money, you need to analyze the people you are against and act with it. You might think that poker is about mathematics and probabilities as well, but it is also about psychology and human interaction.

We often think that the world is a rational place that can be explained with science and mathematics. That is wrong because we are people. People are irrational, unreliable and can be wrong and cannot be interpreted with quantitative methods. And when it comes to making money in the economy, buying the pot is the situation where you want to put yourself in.

Text: SW

Pictures don't belong to me

Wednesday, 4 October 2017

A Little Bit of Inflation

We all know our common friend, the inflation. Inflation basically means the increase in the general price level of goods and services. In practice this means that when time goes by, you are able to buy less with your monthly salary than before. For example if inflation-rate is 2 %, that means that the general price level is rising all the time with a rate of 2 % and the real value of your money is decreasing with a rate of 2 %.

The European Central Bank for example has a goal of maintaining the rate of inflation at below but close at 2 % in the medium term. However, in some countries like in Venezuela, the inflation-rate is currently estimated to be 11 200 000 %. That means that the Zimbabwean dollar is almost completely unvaluable! Even Habbo-coins are 60 000 times more valuable currency than the Zimbabwean dollar.

My friend actually showed me a bill of 1 000 000 000 000 Zimbabwean dollars that he has managed to get from his cousin in Africa. He also said that the monthly salaries of people are delivered by a truck! In the restrooms it is forbidden to use bills as a toilet paper. How on earth did Zimbabwe get into this situation

Couple of reasons exist for hyperinflation. First of all is corruption. In the countries where the government have their hands on the central bank, it might become lucrative to fund the government's deficit by printing more money. This increases rapidly the money supply in the economy, which according to quantity theory of money, increases inflation. For example in Zimbabwe, the Mugabe administration decided to print more money in the early 2000's to increase the salaries for the people in the government and in the military. These economic mis-steps inevitably lead to unrest and poverty. Because of corruption and excessive money creation, the economy and and the people are suffering.

Now the big question is that is the hyperinflation a fixable problem? Well, at least in Germany after the first World War, the government managed to get the hyperinflation in control. This was done basically by inventing a whole new currency to be backed by mortgage bonds indexed to the market price of gold at the time.

If Zimbabwe and Venezuela want to do the same, this suggests that they would have to also abandon the old currency and to develop a new one. Unfortunately in the current foreign exchange market most of the values of the currencies are determined by the supply and demand of these currencies. It is very rare to possess a currency that would have its value fixed or pegged to some commodity, for instance. This might make it difficult for example to Zimbabwe to find the demand for its new currency.

I started to think an interesting option: Bitcoin. Most of the currencies are inflationary, but would virtual currencies such as Bitcoin work as an official currency of a country? What if the official currency of Zimbabwe would be Bitcoin?

Bitcoin is considered a very controversial currency. For instance, the European Central Bank has stated that it doesn't define Bitcoin as a currency, since it doesn't possess enough characteristics and qualities of a currency. I would agree on that. Bitcoin seems more of a speculative instrument for investors than an official currency. Although Bitcoin is already used in the internet as a valid currency for payments between consumers and service providers all over the world.

If something is interesting in Bitcoin as a currency, it is the fact that unlike any other currency we know, Bitcoin is a deflationary currency. This means that the real of Bitcoin is increasing over time (or at least has increased). Euro, pound sterling and the dollar on the other hand have decreased in real value over time as you can see from the graphs above. Why you ask? The inflation.

But why doesn't Bitcoin produce inflation? The maximum amount of Bitcoins in the world is fixed. The algorithm in the so called block-chain creates more and more Bitcoins with a decreasing growth rate, until the maximum amount is reached. In practice the calculations become more and more complex and when more Bitcoins are created, the more time it takes to create more. Because the supply of money in this case is fixed, Bitcoin doesn't create inflation in a way like traditional currencies do.

This is why the value of the currency is increasing. When the demand for Bitcoins increases, the value of the Bitcoin also increases since the supply cannot adjust to the increased demand for Bitcoins.

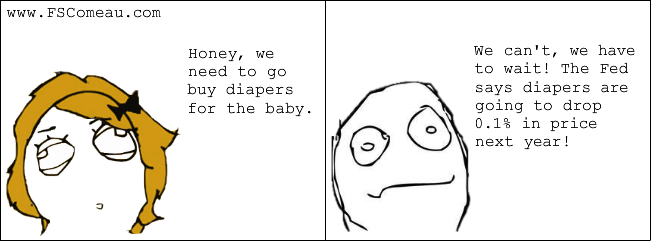

The consequences of using a deflationary currency could be interesting. There exist a danger that consumers are waiting for the value of their currency to increase before consuming goods and services. This would decrease the amount of consumption in the economy and can lead to lower rates of economic growth. Also the amount of investments will be reduced when the currency itself can be seen as a form of investment. Similarly the reduced revenue of firms and corporations can lead to unemployment.

But what about a country like Zimbabwe, where already the unemployment rate is over 90 % and the level of investments and consumption are relatively low? In theory the negative effects are already been gone through, so we would need to focus on the positive effects of deflation.

Deflation itself increases the amount of disposable funds especially for middle class and poor people, when the value of their small amount of money is increasing. This might be used to boost the consumption in the Zimbabwean economy. Similarly deflation would require the central bank to lower its interest rates, which would make loans more cheap for consumers, which could can increase the amount of consumption in the economy even more.

Deflation would also decrease the value of assets when the currency would become an alluring form of investment. Then the wealth of the rich government officials who own for example property and stocks, would decrease. When the wealth of the poor people on the other hand increases, this would also decrease the economic inequality in the economy.

When more loans are granted, this would also mean that the money supply in the economy would increase again. However the maximum amount of Bitcoins is fixed and this relationship would create an interesting dilemma I would need to think further. I also know there are probably many controversies concerning these theories but I wanted to discuss some of my thoughts on the matter.

Text SW

Pictures don't belong to me

Subscribe to:

Posts (Atom)

.jpg)